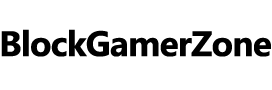

Q DeFi Ranking is already in operation. It aggregates and analyzes data on Ethereum, Binance Sensible Chain, Heco, Matic, Tron, Polkadot in addition to different blockchains.

The “by no means make investments cash that you could’t afford to lose” rule applies simply as a lot to the crypto world because it does to investments in conventional finance. Asset volatility, the complexity of methods and the very nature of investments themselves make it a high-risk affair. Failing to know the dangers concerned can result in losses.

Q DeFi Ranking goals to assist customers allocate their funds well with its superior portfolio administration toolkit and a fully-fledged database of knowledge on the DeFi market. Centered on offering correct and complete analytics on each place, the platform allows customers to raised assess the efficiency of their funds and the dangers concerned, enabling them to react to market adjustments in a well timed method. Our mission and pool rankings together with our Analysis Heart present the important information customers must make well-informed selections.

Customers can create a private account on Q DeFi Ranking by merely logging in with their pockets and including all of the addresses they wish to monitor.

APY and ROI Function Places a Cease to Miscalculated Returns

APY along with ROI is commonly used to evaluate a place’s efficiency and beneficial properties, in comparison with different funding alternatives. Judging by the numbers displayed by tasks, customers are at all times left with deceptive data. By design, APY is a fluctuating metric that is determined by token volatility, liquidity within the pool, demand for provided property and impermanent loss. The APYs introduced by tasks are an estimation of what customers obtain provided that all the underlying components stay the identical, which is unimaginable.

Q DeFi Ranking addresses this challenge by displaying the typical APY which a pool may generate within the subsequent 3 days, one month or three months. The system analyzes how the pool carried out up to now and estimates the returns primarily based on historic information. Thus, traders can higher perceive liquidity movement and what rewards to anticipate in order that they will alter their technique accordingly.

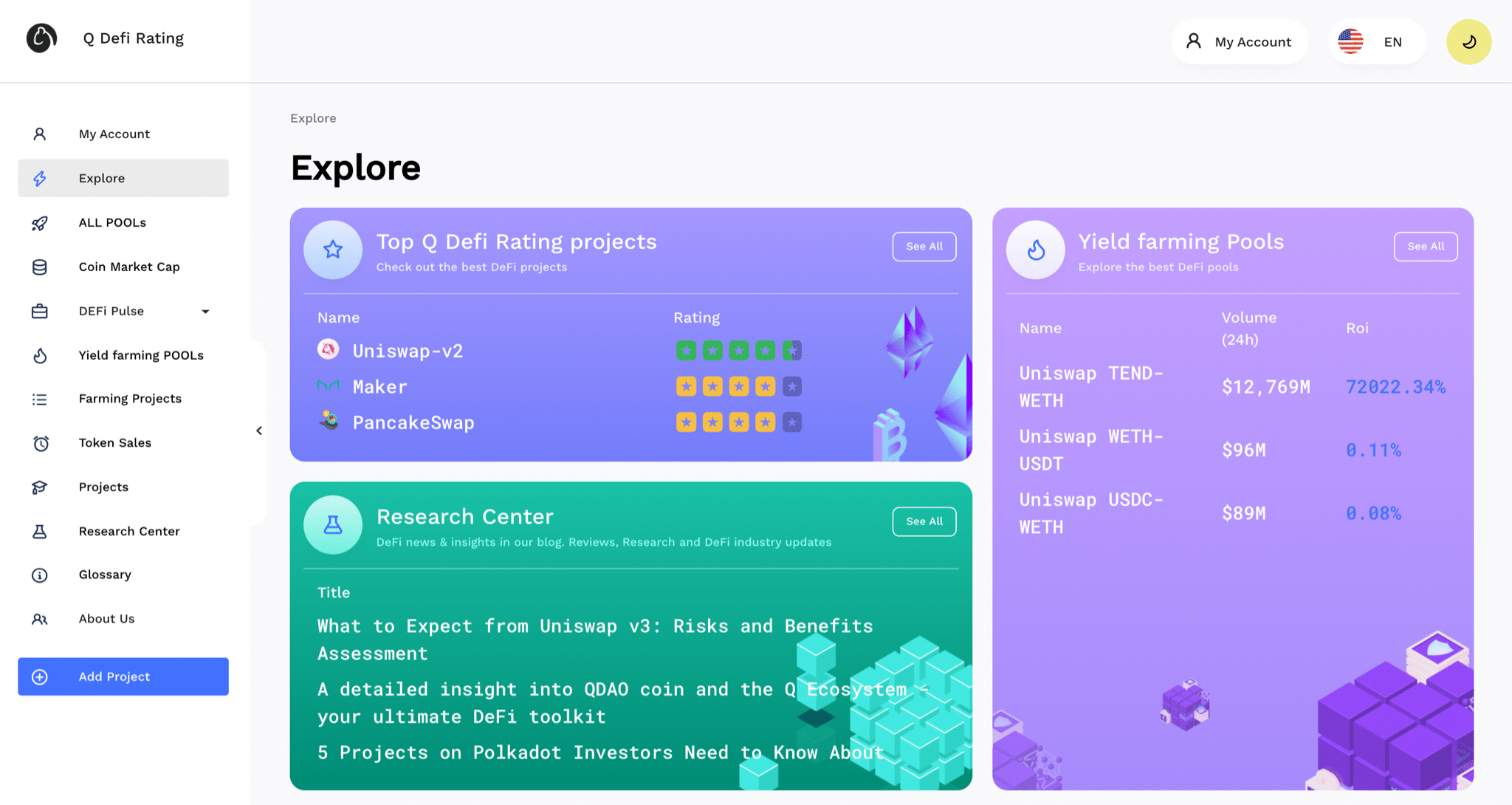

The Q DeFi Ranking system additionally considers elements of liquidity movement which are usually neglected. APY and ROI are the returns that customers accumulate whereas lending, staking or farming. These metrics don’t think about the steps taken to take part within the pool or to reap the returns. Q DeFi Ranking in flip tracks the Gasoline charges paid for the deposit, estimates the withdrawal price and shows the precise revenue customers make after taking good care of all the prices.

Moreover, the information is introduced alongside a comparability with how the identical property would have carried out underneath a HODLing technique. This function offers customers a greater understanding of which technique may generate the most important beneficial properties and the way it is perhaps higher to behave subsequent time.

Mitigating Impermanent Loss with the Assist of Q DeFi Ranking

Impermanent loss is an issue no crypto investor can steer clear of. The danger could be minimized by enjoying secure and investing solely in stablecoin pairs and avoiding risky cryptocurrencies. In all different circumstances, it comes right down to the diploma of danger a person is able to take.

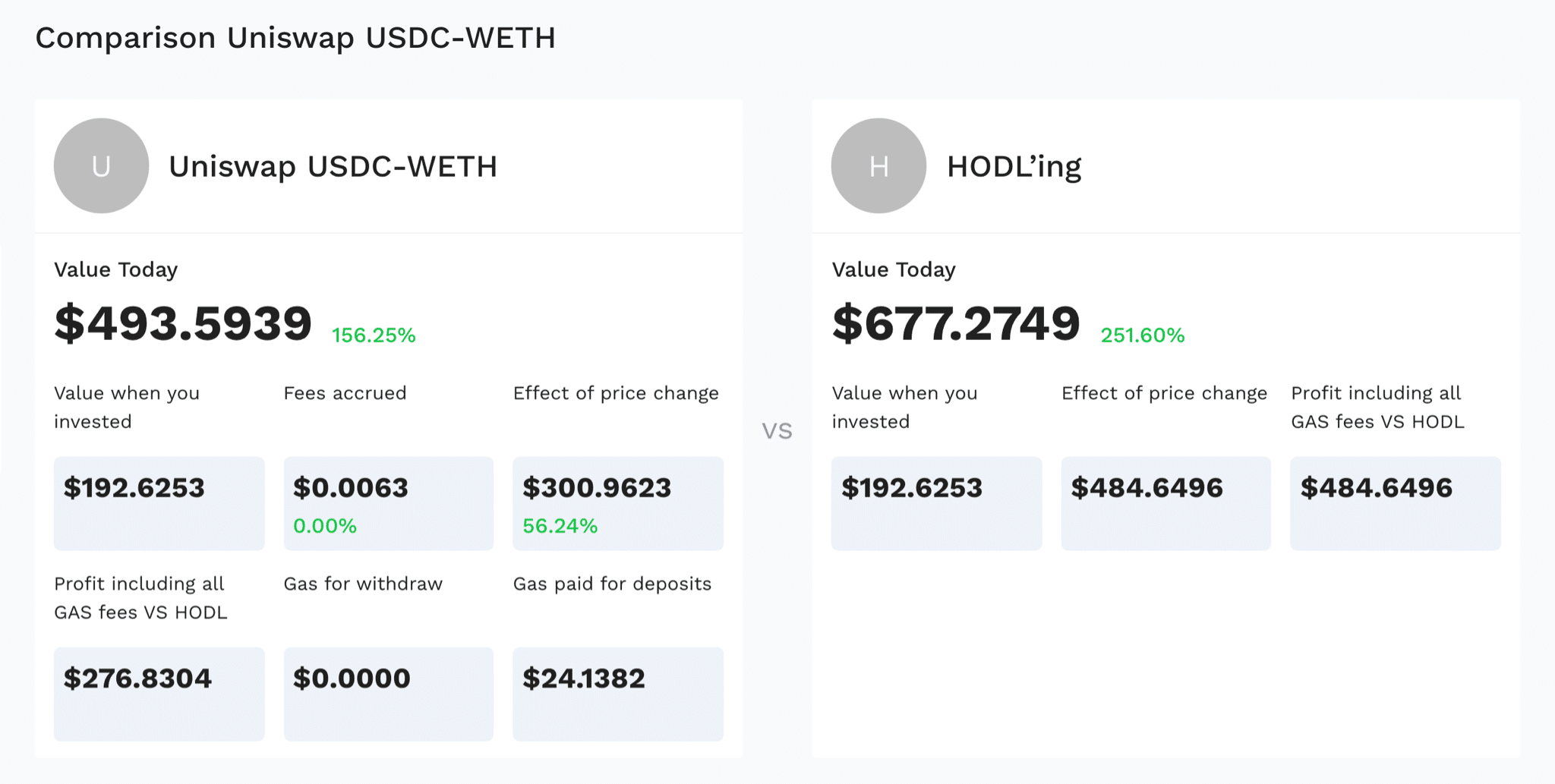

Q DeFi Ranking makes it simpler to estimate the quantity of loss that may happen within the foreseeable future, to assist customers resolve whether or not it’s value it in any respect. Customers can test the Anticipated Impermanent Loss by going to the web page devoted to the pool they’re fascinated with.

As soon as the funds are invested, customers can monitor the impression that impermanent loss is having on their positions through the dashboard.

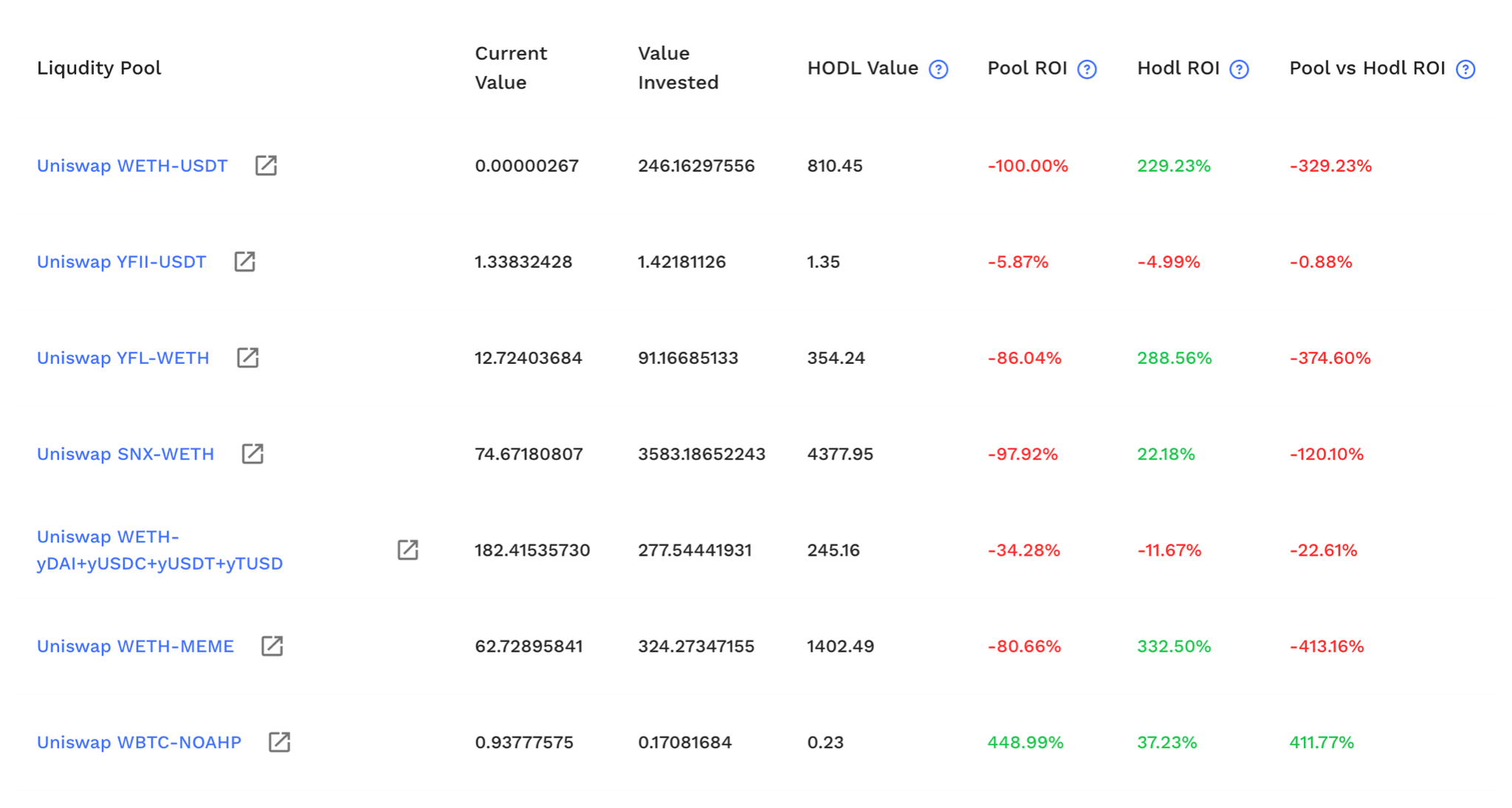

The efficiency of every place is measured by six metrics:

- The Present Worth and Worth Invested columns are easy.

- The HODL Worth calculates what the worth of customers’ property can be if they’d stored them of their pockets, with out investing wherever.

- Pool ROI is the sum of Value ROI and Alternate ROI. Value ROI signifies the proportion of returns that happen purely because of asset volatility between the date of the preliminary funding and the present second. Alternate ROI reveals the mix of charges amassed through the staking interval, attainable impermanent loss and earnings in platform governance tokens.

- HODL ROI is very like HODL Worth however is expressed as a proportion.

- Pool ROI vs. HODL ROI is solely the distinction between the 2.

Thus, customers can see precisely how their funds are performing, what impact every issue has on their ultimate returns and what technique works greatest.

Researching and Validating New Funding Alternatives

Q DeFi Ranking has traders’ ache coated throughout the entire journey. A giant a part of that is discovering new tasks and checking their reliability. Q DeFi Ranking aggregates data on the entire DeFi business and helps customers to seek for and analyze new tasks and swimming pools, even when they lack data in tech and economics.

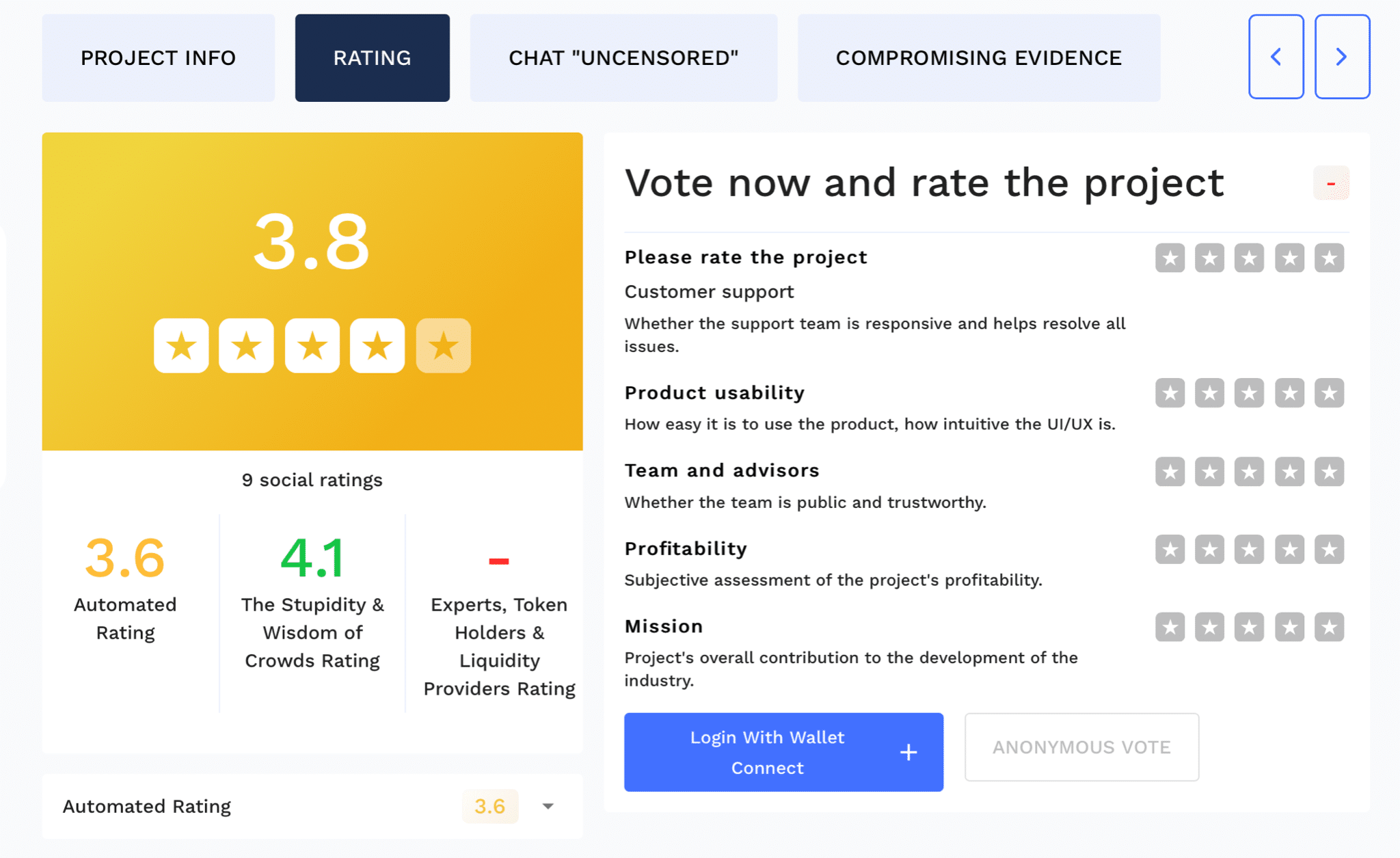

Every mission has its personal web page that options its normal data and ranking. The ranking system relies on a proprietary system and considers components resembling liquidity, commerce quantity, pool length, governance token provide, good contract vulnerability, how the client assist works and what token holders and liquidity suppliers need to say about it. Discovering new gems comes right down to flick thru the pages on Q DeFi Ranking.

Q DeFi Ranking is already in operation. It aggregates and analyzes data on Ethereum, Binance Sensible Chain, Heco, Matic, Tron, Polkadot in addition to different blockchains. Powered by its distinctive methodology, it gives customers with complete analytics in a easy and intuitive type.

You’ll be able to create your account right here. Additionally be part of the Telegram chat to debate platform updates and observe Q DeFi Ranking on Twitter to remain within the loop.

subsequent

Having obtained a diploma in Intercultural Communication, Julia continued her research taking a Grasp’s diploma in Economics and Administration. Turning into captured by modern applied sciences, Julia turned keen about exploring rising techs believing of their skill to remodel all spheres of our life.